Optimizing Your Financial Systems With Bookkeeping 6692206405

In today’s competitive landscape, effective bookkeeping emerges as a critical component for financial system optimization. Organizations must recognize the importance of accurate record-keeping to enhance transparency and decision-making. By adopting strategic practices and advanced tools, they can streamline processes and improve cash flow management. However, the journey towards financial clarity is multifaceted and requires a deeper exploration of specific strategies and technologies that can yield substantial benefits.

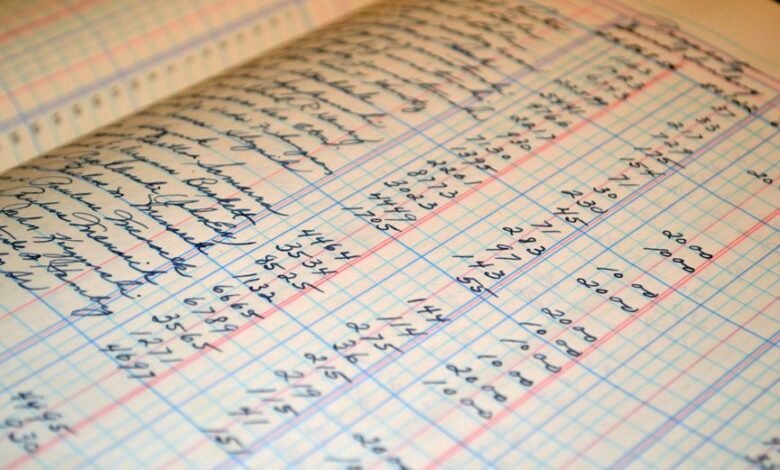

Understanding the Importance of Effective Bookkeeping

Effective bookkeeping serves as the backbone of sound financial management, as it provides organizations with a clear and accurate representation of their financial health.

By meticulously tracking expenses and monitoring cash flow, businesses can identify trends, allocate resources effectively, and make informed strategic decisions.

This clarity empowers organizations to optimize operations, ensuring they maintain financial freedom and resilience in a dynamic marketplace.

Key Strategies for Streamlining Your Financial Processes

Accurate bookkeeping lays the groundwork for optimizing financial processes, allowing organizations to identify inefficiencies and areas for improvement.

Key strategies include automating invoicing to reduce manual errors and enhance cash flow management.

Additionally, implementing robust expense tracking systems provides real-time insights into expenditures, enabling informed decision-making.

These strategies foster a streamlined financial environment, ultimately granting organizations the freedom to focus on growth and innovation.

Tools and Technologies to Enhance Bookkeeping Efficiency

Harnessing the right tools and technologies can significantly enhance bookkeeping efficiency, transforming how organizations manage their financial data.

Cloud accounting systems offer real-time access and collaboration, while automation software reduces manual entry errors and streamlines repetitive tasks.

Best Practices for Maintaining Accurate Financial Records

Utilizing advanced tools and technologies sets the foundation for maintaining accurate financial records.

Regular record reconciliation ensures discrepancies are promptly identified and resolved, enhancing overall data integrity.

Implementing systematic filing and documentation practices bolsters audit preparedness, allowing for seamless reviews.

Ultimately, adhering to these best practices not only fosters financial accuracy but also empowers individuals seeking freedom in their financial management and decision-making processes.

Conclusion

In conclusion, optimizing financial systems through effective bookkeeping is akin to fine-tuning a well-oiled machine; each component must work seamlessly to ensure peak performance. By embracing key strategies, leveraging advanced technologies, and adhering to best practices, organizations can navigate the complexities of today’s marketplace with precision and confidence. This strategic approach not only enhances cash flow management but also cultivates resilience, allowing businesses to adapt and thrive amidst financial challenges.