Managing Accounts for Growth With Bookkeeping 4787427582

Effective account management is essential for business growth. Accurate bookkeeping serves as the foundation for informed decision-making and financial stability. By implementing key practices and leveraging technological advancements, companies can enhance their operational efficiency. This strategic approach not only ensures compliance but also positions businesses to capitalize on emerging opportunities. Understanding these dynamics is crucial for navigating the complexities of the financial landscape and fostering sustainable growth. What are the specific strategies that can drive this process?

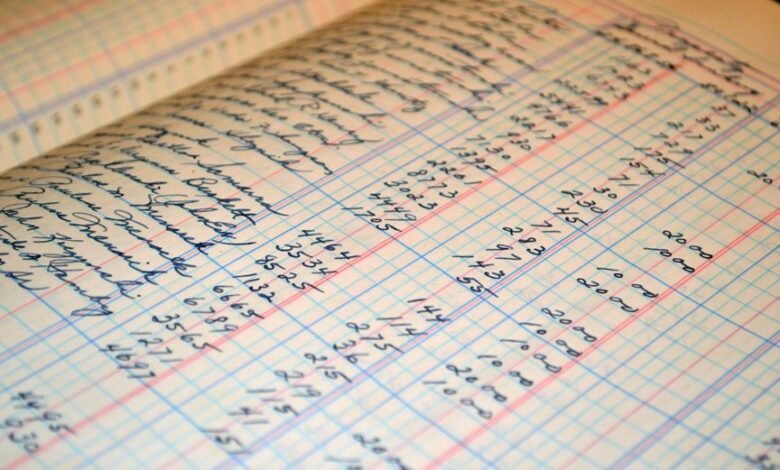

The Importance of Accurate Bookkeeping

Accurate bookkeeping is a fundamental pillar for any organization aiming for sustainable growth. It ensures financial accuracy, allowing businesses to make informed decisions based on reliable data.

Furthermore, it provides compliance assurance, mitigating risks associated with regulatory violations. By prioritizing precise record-keeping, organizations can enhance operational efficiency, fostering an environment where freedom to innovate and expand flourishes, ultimately driving long-term success.

Key Bookkeeping Practices for Small Businesses

Effective bookkeeping practices are vital for small businesses aiming to maintain financial health and support growth.

Strategic cash flow management ensures timely payments and sustainable operations, while diligent expense tracking allows for informed decision-making.

Leveraging Technology in Financial Management

As small businesses increasingly recognize the importance of efficiency, leveraging technology in financial management becomes essential for optimizing operations.

Cloud accounting solutions and advanced financial software facilitate real-time data access, streamline bookkeeping tasks, and enhance decision-making capabilities.

Strategies for Sustainable Growth Through Effective Bookkeeping

Implementing robust bookkeeping practices serves as a cornerstone for sustainable growth in small businesses.

By meticulously tracking cash flow, companies can identify trends and make informed decisions. Effective financial forecasting, grounded in accurate records, allows for strategic planning, enabling businesses to allocate resources efficiently and seize opportunities.

Ultimately, these practices empower entrepreneurs to navigate uncertainties while fostering financial independence and long-term success.

Conclusion

In the realm of business, where every decision echoes in the corridors of opportunity, accurate bookkeeping emerges as the unsung hero. Like a compass guiding a ship through turbulent waters, meticulous financial records empower businesses to navigate challenges and seize growth opportunities. By embracing key practices and leveraging technology, organizations can not only ensure compliance but also cultivate resilience and adaptability. In this competitive landscape, effective bookkeeping is not merely a task; it is the foundation upon which sustainable success is built.