Key Techniques in Bookkeeping 5089486999

Effective bookkeeping is crucial for maintaining accurate financial records. It involves systematic organization, regular reconciliations, and the use of advanced software solutions. These techniques not only minimize errors but also foster transparency. However, the implementation of these strategies requires a deeper understanding of their fundamental principles and best practices. An exploration of these elements reveals the potential for improved financial integrity and operational efficiency. What specific methods can most significantly enhance a business’s bookkeeping process?

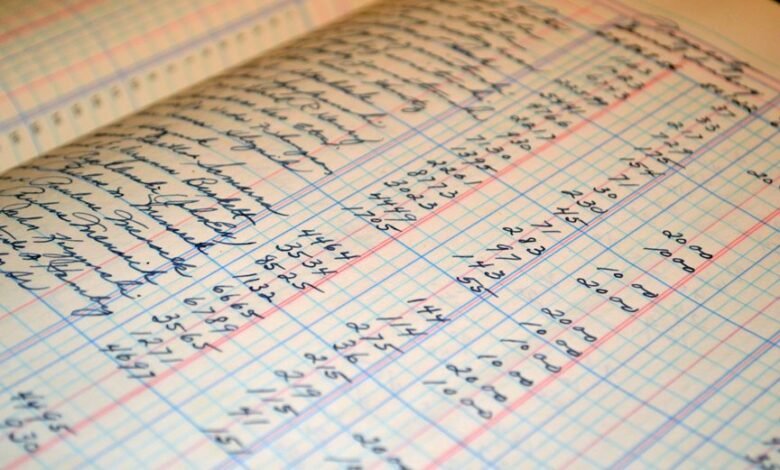

Understanding the Fundamentals of Bookkeeping

Bookkeeping serves as the backbone of financial management for businesses, providing a systematic method for recording and organizing financial transactions.

Basic bookkeeping principles ensure accurate tracking of income and expenses, allowing for the creation of reliable financial statements.

The Importance of Regular Reconciliations

Regular reconciliations play a pivotal role in maintaining the integrity of financial records.

By establishing an appropriate reconciliation frequency, businesses can ensure heightened transaction accuracy. This process allows discrepancies to be identified and rectified promptly, fostering trust in financial reporting.

Ultimately, regular reconciliations empower organizations to make informed decisions, enhancing their operational freedom while safeguarding against financial mismanagement and errors.

Leveraging Bookkeeping Software for Efficiency

Utilizing advanced bookkeeping software can significantly enhance operational efficiency for businesses of all sizes.

By adopting cloud solutions, organizations can access financial data anytime, anywhere, promoting flexibility and collaboration.

Automated invoicing streamlines billing processes, reducing human error and saving time.

This integration of technology not only fosters productivity but also empowers businesses to focus on growth and strategic decision-making.

Best Practices for Maintaining Accurate Records

Accurate record-keeping is essential for any organization seeking to maintain financial integrity and compliance.

Best practices include systematic record organization, ensuring data accuracy through regular audits, and employing reliable software tools.

Establishing clear protocols for data entry and storage fosters consistency.

Conclusion

In conclusion, effective bookkeeping is akin to a well-tuned orchestra, where each instrument must harmonize to create a cohesive sound. Just as a conductor ensures every musician plays their part accurately, maintaining systematic record organization, regular reconciliations, and utilizing advanced software guarantees financial integrity. By adhering to best practices, businesses can orchestrate their financial health, fostering trust and transparency. Ultimately, a symphony of precise bookkeeping not only supports compliance but also elevates the overall performance of an organization.