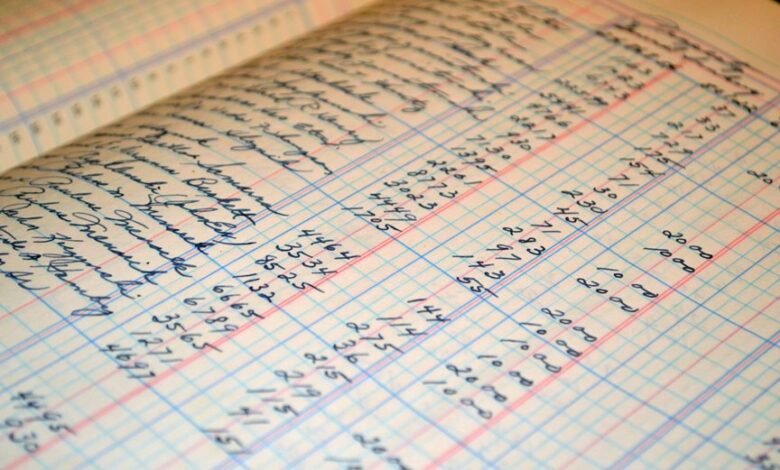

Key Concepts in Bookkeeping 7155021392

Key concepts in bookkeeping form the foundation of sound financial management. These principles, including the double-entry accounting system, ensure accurate records and facilitate effective decision-making. Essential tools and software streamline processes, while awareness of common mistakes safeguards precision. Understanding these elements is crucial for any business aiming for financial health. However, the complexities involved raise important questions about best practices and potential pitfalls that warrant further exploration.

Understanding Financial Statements

Financial statements serve as the foundational documents that provide a comprehensive overview of an entity’s financial performance and position.

Among these, the balance sheet is crucial, detailing assets, liabilities, and equity.

Financial ratios derived from these statements enable stakeholders to assess the entity’s liquidity, profitability, and solvency, facilitating informed decisions that support financial independence and strategic growth within the marketplace.

The Principles of Double-Entry Accounting

The principles of double-entry accounting form the backbone of accurate financial reporting and analysis.

This system requires each transaction to involve both debit entries and credit entries, ensuring that the accounting equation remains balanced.

Essential Bookkeeping Tools and Software

While many businesses recognize the importance of maintaining accurate financial records, understanding the essential bookkeeping tools and software available can significantly enhance efficiency and accuracy.

Effective cloud solutions offer real-time access to financial data, while accounting integrations streamline processes by connecting various financial platforms.

Utilizing these tools not only simplifies bookkeeping tasks but also empowers businesses to make informed financial decisions with greater autonomy.

Common Bookkeeping Mistakes to Avoid

Numerous businesses overlook critical bookkeeping practices, leading to common mistakes that can undermine financial accuracy.

Frequent data entry errors, such as incorrect figures or misclassified transactions, often occur.

Additionally, reconciliation errors can arise when businesses fail to match their records with bank statements.

Conclusion

In the intricate tapestry of bookkeeping, each thread—be it financial statements, double-entry principles, or the tools employed—intertwines to create a coherent financial narrative. Recognizing common pitfalls serves as a compass, guiding practitioners away from treacherous waters. Mastery of these key concepts not only fortifies a business’s financial foundation but also illuminates the path to informed decision-making and sustainable growth. Ultimately, proficient bookkeeping transforms raw numbers into a strategic blueprint for prosperity.