Financial Accuracy in Bookkeeping 18449270314

Financial accuracy in bookkeeping is crucial for informed decision-making and maintaining stakeholder trust. Businesses face challenges in navigating complex financial landscapes, where meticulous data entry and systematic record organization play a pivotal role. Regular audits and reconciliations can significantly enhance the integrity of financial records. However, many organizations overlook common pitfalls that may compromise their financial accuracy, raising questions about the effectiveness of their current practices. Understanding these intricacies is essential for fostering a resilient financial environment.

The Significance of Financial Accuracy in Bookkeeping

Financial accuracy in bookkeeping is paramount, as it serves as the foundation for effective business decision-making and financial reporting.

Upholding financial integrity through meticulous record-keeping fosters trust among stakeholders. Adhering to bookkeeping ethics ensures transparency and compliance, empowering businesses to navigate complex financial landscapes.

Ultimately, accurate bookkeeping enhances organizational resilience and promotes a culture of accountability, enabling informed choices that drive success and freedom.

Best Practices for Maintaining Accurate Financial Records

Maintaining accurate financial records is essential for businesses striving for efficiency and reliability in their operations.

Implementing best practices such as meticulous data entry and systematic record organization enhances transparency and minimizes errors.

Regular audits and reconciliations further ensure integrity, while adopting digital tools can streamline processes.

Adhering to these principles fosters an environment of trust and empowers organizations to make informed financial decisions.

Common Pitfalls to Avoid in Bookkeeping

While striving for accuracy in bookkeeping, organizations often encounter common pitfalls that can compromise their financial integrity.

Inaccurate entries can lead to significant discrepancies, distorting financial analysis. Furthermore, missing receipts create gaps in documentation, potentially resulting in compliance issues.

Awareness of these pitfalls is essential for organizations seeking to maintain precise financial records and uphold their fiscal responsibility.

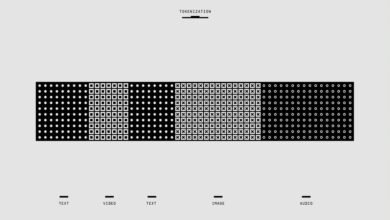

Tools and Technologies for Ensuring Financial Accuracy

Organizations can mitigate the risks associated with common bookkeeping pitfalls by leveraging advanced tools and technologies designed to enhance financial accuracy.

Cloud software offers real-time data accessibility, enabling timely decision-making. Additionally, automated reconciliation streamlines the matching process of transactions, reducing human error.

Conclusion

In conclusion, financial accuracy in bookkeeping is not merely important; it is the lifeblood of an organization, fueling informed decision-making and sustaining stakeholder trust. By adhering to best practices and leveraging modern tools, businesses can avoid common pitfalls and maintain impeccable records. Cultivating a culture of accountability further enhances this endeavor, ensuring that financial integrity remains unassailable. Ultimately, prioritizing accuracy in bookkeeping transforms financial management from a mundane task into a cornerstone of organizational resilience and success.