Essentials for Small Businesses in Bookkeeping 18332147629

Effective bookkeeping is a cornerstone for small business success. It encompasses systematic transaction recording, the use of cloud-based tools, and organized record maintenance. By adhering to best practices and recognizing common pitfalls, businesses can enhance their financial clarity. Understanding these essentials lays the groundwork for informed decision-making. However, many small enterprises still overlook critical aspects of bookkeeping, leading to potential mismanagement. Exploring these nuances can reveal significant opportunities for improvement.

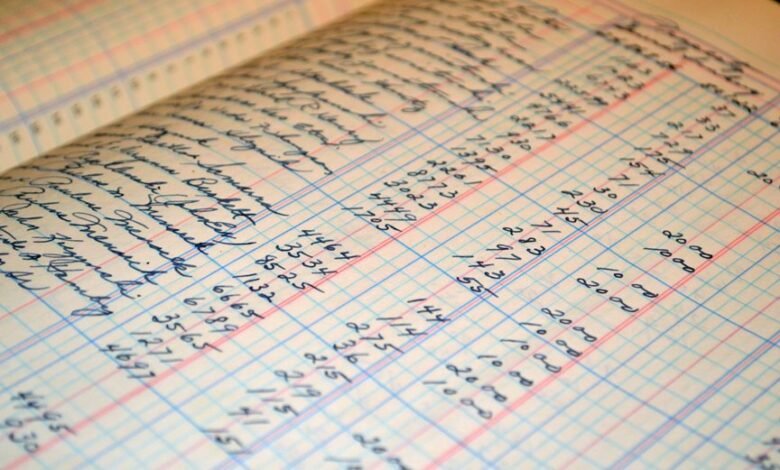

Understanding the Basics of Bookkeeping

Bookkeeping serves as the backbone of financial management for small businesses, providing a systematic method for recording and organizing financial transactions.

Understanding bookkeeping terminology is essential, as it helps business owners interpret financial statements accurately.

This foundational knowledge enables them to assess profitability and make informed decisions, ultimately fostering financial independence and ensuring their businesses thrive in a competitive landscape.

Essential Tools for Efficient Bookkeeping

To ensure efficient bookkeeping, small businesses must leverage the right tools that streamline financial processes and enhance accuracy.

Cloud software offers scalable solutions for managing finances, allowing for real-time collaboration and remote access.

Additionally, effective expense tracking tools simplify monitoring expenditures, ensuring that businesses maintain control over their financial health.

Together, these resources empower small businesses to achieve greater financial freedom and efficiency.

Best Practices for Maintaining Accurate Records

Although maintaining accurate records may seem straightforward, small businesses must adopt systematic practices to ensure precision and reliability in their financial documentation.

Effective record organization is crucial, allowing for easy retrieval and review. Regular financial reconciliation further enhances accuracy, identifying discrepancies promptly.

Common Mistakes to Avoid in Bookkeeping

Avoiding common mistakes in bookkeeping is essential for small businesses striving for financial accuracy. Errors in data entry can lead to significant financial discrepancies, undermining trust and decision-making.

Failing to reconcile accounts regularly can exacerbate these issues, obscuring a business’s true financial position. By prioritizing meticulous data management and consistent reviews, small businesses can maintain clarity and foster growth in a competitive landscape.

Conclusion

In the grand circus of small business finance, mastering bookkeeping is the tightrope act that separates success from disaster. With the right tools and practices, entrepreneurs can dazzle their audience—potential investors and customers alike—while avoiding the pitfalls of financial chaos. However, neglecting these essentials may lead to a tragicomic performance, where profits vanish like a magician’s rabbit. Thus, small business owners must embrace bookkeeping not as a chore, but as the key to their financial acrobatics.