Effective Budgeting and Bookkeeping Techniques in Bookkeeping 4252302520

Effective budgeting and bookkeeping techniques are vital for the financial health of any organization. By implementing structured budget categories, businesses can improve expense tracking and reveal spending trends. Furthermore, leveraging advanced tools enhances efficiency and accuracy in financial management. The interplay between these elements raises important questions about the long-term sustainability of financial practices. Understanding how to analyze financial data can lead to more strategic decisions, prompting further exploration into these essential techniques.

Understanding the Basics of Budgeting in Bookkeeping 4252302520

While many individuals and organizations recognize the importance of financial management, understanding the fundamentals of budgeting within the realm of bookkeeping remains crucial for effective financial oversight.

Establishing clear budget categories enhances expense tracking, allowing for a structured approach to financial planning. This method enables individuals and organizations to identify spending patterns, allocate resources wisely, and ultimately achieve greater financial freedom and accountability.

Essential Bookkeeping Practices for Accurate Financial Management

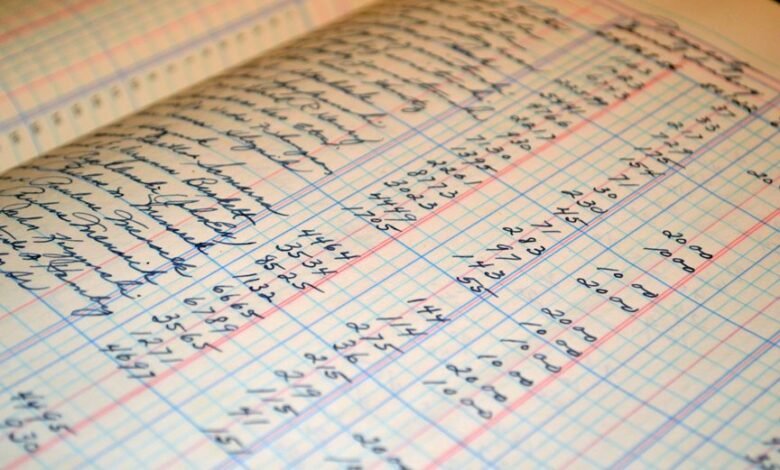

Implementing essential bookkeeping practices is fundamental for achieving accurate financial management. Effective record keeping ensures that all financial transactions are documented systematically, facilitating transparency.

Furthermore, diligent expense tracking allows individuals and businesses to monitor their spending patterns, identify areas for cost reduction, and enhance overall financial health.

Adhering to these practices empowers stakeholders to make informed decisions and fosters financial independence.

Tools and Software to Enhance Budgeting and Bookkeeping Efficiency

An array of tools and software is available to enhance the efficiency of budgeting and bookkeeping processes.

Budgeting software facilitates accurate financial planning and tracking, providing users with real-time insights. Similarly, bookkeeping apps streamline data entry and automate routine tasks, reducing errors and saving time.

Collectively, these technologies empower users to maintain financial freedom while ensuring meticulous management of their resources.

Analyzing Financial Data for Informed Decision-Making

Effective decision-making in financial management hinges on the thorough analysis of financial data, which allows organizations to identify trends, assess performance, and allocate resources wisely.

Employing financial forecasting techniques enhances predictive accuracy, while data visualization tools effectively communicate complex information.

This strategic approach empowers organizations to adapt to market changes, optimize operations, and ultimately achieve greater financial autonomy, fostering informed decision-making.

Conclusion

In the grand theater of finance, where spreadsheets dance and budgets waltz, one mustn’t forget the chorus of diligent bookkeeping. With tools that promise to streamline while cleverly masking errors, the stage is set for informed decision-making—if only one can decipher the cryptic data. Thus, in this comedic ballet of numbers, effective budgeting and bookkeeping techniques emerge not as mere suggestions but as the protagonists in the quest for fiscal harmony and stability, ever adapting to the whims of the market.