Building a Financial Framework With Bookkeeping 4694479430

Establishing a robust financial framework through bookkeeping is critical for organizational success. It incorporates fundamental principles like the double-entry system and accrual accounting. Effective tools and software enhance accuracy in financial record-keeping. Furthermore, regular analysis of financial data reveals trends and opportunities. This systematic approach not only supports strategic decision-making but also prepares businesses for market fluctuations. Understanding these elements is essential for those aiming to optimize their fiscal management. What specific strategies can be employed to achieve this?

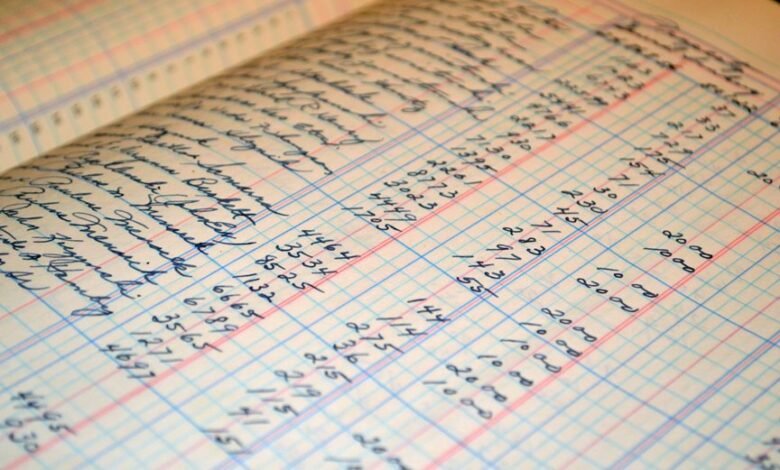

Understanding the Basics of Bookkeeping

Bookkeeping serves as the foundational element of effective financial management for businesses.

Understanding bookkeeping principles, such as the double-entry system and the accrual basis, is crucial for accurate financial reporting.

Mastery of financial terminology enables entrepreneurs to interpret financial statements, making informed decisions.

This knowledge fosters autonomy, empowering business owners to navigate their financial landscape with confidence and clarity.

Essential Tools for Effective Bookkeeping

Effective financial management relies not only on understanding bookkeeping principles but also on utilizing the right tools that streamline the process.

Software solutions enhance record accuracy and facilitate efficient data management, enabling individuals to maintain precise financial records.

Implementing Best Practices for Financial Management

Establishing best practices for financial management is crucial for any organization seeking to optimize its fiscal health.

Implementing robust financial policies ensures clarity in cash flow management, enabling organizations to maintain liquidity and support strategic initiatives.

Regular assessments of financial practices will foster adaptability, empowering organizations to respond effectively to evolving market conditions while safeguarding their financial stability and promoting sustainable growth.

Analyzing Financial Data for Strategic Decision Making

A comprehensive analysis of financial data is essential for informed strategic decision-making within any organization.

By identifying financial trends and employing data visualization techniques, businesses can uncover valuable insights that drive growth and efficiency.

This analytical approach facilitates the assessment of potential opportunities and risks, empowering leaders to make data-driven decisions that support organizational freedom and long-term success.

Conclusion

In conclusion, establishing a robust financial framework through bookkeeping is crucial for organizational success. By embracing the adage “what gets measured gets managed,” businesses can leverage essential tools and best practices to ensure accurate financial records. Regular analysis of financial data not only reveals trends and opportunities but also supports informed decision-making. Ultimately, a strategic approach to bookkeeping empowers organizations to navigate market fluctuations, fostering growth and sustainability in an ever-evolving economic landscape.