Understanding Financial Records in Bookkeeping 5025130632

Understanding financial records in bookkeeping is crucial for any organization. Accurate documentation reveals the true fiscal state, influencing decision-making and compliance. Key components such as income statements and balance sheets play a pivotal role. However, maintaining these records requires adherence to best practices. What are the common pitfalls organizations face, and how can they ensure their financial documentation remains robust and reliable? The following sections will explore these critical aspects in greater detail.

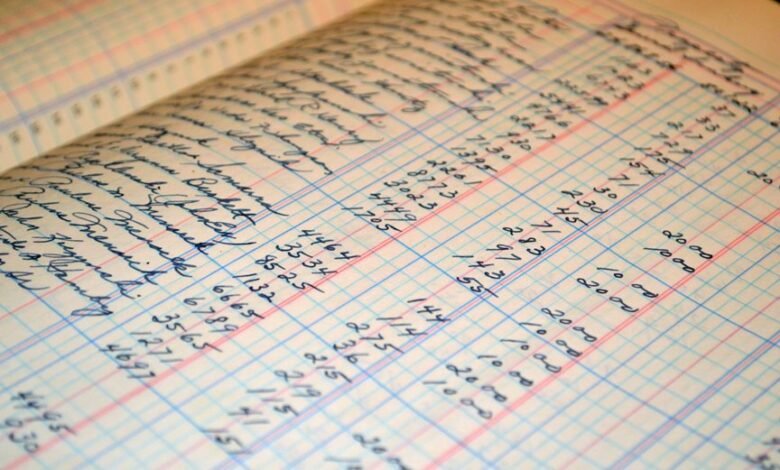

The Importance of Accurate Financial Records

Accurate financial records serve as the backbone of effective bookkeeping, enabling organizations to maintain a clear and precise understanding of their financial health.

Financial accuracy in record keeping is crucial, as it fosters informed decision-making, compliance, and strategic planning.

Key Components of Financial Documentation

While financial documentation may seem straightforward, it encompasses several critical components that together form a comprehensive overview of an organization’s fiscal activities.

Key elements include financial statements, which summarize financial performance and position, and effective record keeping practices that ensure accuracy and compliance.

Together, these components facilitate informed decision-making and transparency, allowing stakeholders to understand the organization’s financial health and operational efficacy.

Common Types of Financial Records

Financial records serve as the backbone of an organization’s bookkeeping system, providing detailed insights into various aspects of its financial operations.

Common types of financial records include income statements and balance sheets. Income statements summarize revenues and expenses, while balance sheets offer a snapshot of assets, liabilities, and equity.

Together, these documents facilitate informed decision-making and promote financial transparency within the organization.

Best Practices for Maintaining Financial Records

Maintaining financial records with diligence ensures that an organization can effectively monitor its fiscal health and comply with regulatory requirements.

Implementing best practices involves establishing a robust record retention policy and utilizing digital backups to safeguard data.

Regular audits and systematic organization of documents further enhance accessibility and reliability, empowering organizations to make informed decisions while fostering transparency and accountability in financial management.

Conclusion

In the intricate tapestry of an organization’s financial landscape, accurate records serve as the guiding threads that weave together clarity and compliance. Each income statement and balance sheet acts as a reflective mirror, revealing the true essence of fiscal health. By adhering to best practices and ensuring meticulous documentation, stakeholders can navigate the labyrinth of financial data with confidence, illuminating pathways to informed decisions and strategic growth that propel the organization toward a prosperous future.