Improving Your Financial Health With Bookkeeping 5305541804

Effective bookkeeping plays a crucial role in enhancing financial health. It involves maintaining accurate records and analyzing financial data to inform decisions. By implementing structured bookkeeping practices, individuals and businesses can identify spending trends and allocate resources more efficiently. The potential benefits of these practices are substantial, yet many overlook their significance. Understanding the core elements of bookkeeping could reveal opportunities for improved financial stability and growth. What specific strategies can be employed to maximize these benefits?

The Importance of Bookkeeping in Financial Management

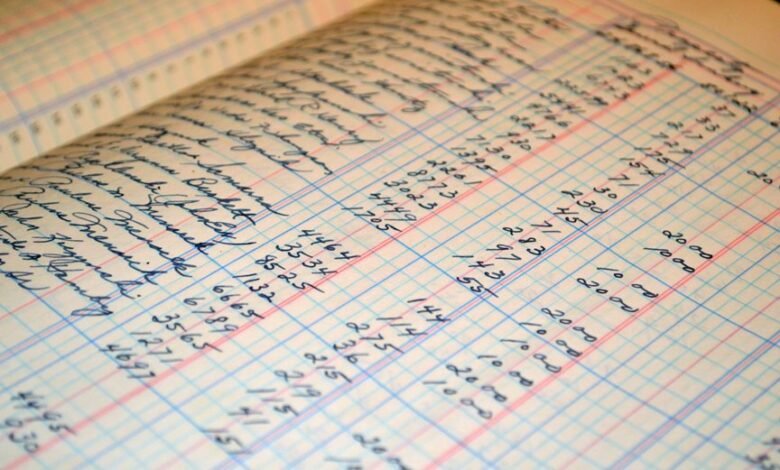

Effective bookkeeping is crucial for robust financial management, serving as the backbone of an organization’s financial health.

It ensures financial accuracy through meticulous record-keeping and enables precise cost tracking.

By maintaining comprehensive financial records, organizations can make informed decisions, optimize resource allocation, and enhance long-term sustainability.

Ultimately, effective bookkeeping empowers entities to achieve greater financial autonomy and stability in a competitive landscape.

Key Bookkeeping Practices to Implement

While many organizations recognize the significance of bookkeeping, implementing key practices is essential for maximizing its benefits.

Maintaining accurate records ensures financial integrity, facilitating informed decision-making. Regularly reviewing these records enhances financial forecasting, allowing organizations to anticipate trends and adapt strategies accordingly.

Tools and Software for Efficient Bookkeeping

A variety of tools and software options are available to streamline bookkeeping processes, significantly enhancing efficiency for businesses of all sizes.

Cloud solutions offer accessibility and scalability, while automation benefits reduce manual tasks, minimizing errors and freeing up time for strategic decision-making.

How to Use Bookkeeping Data to Make Informed Decisions

Leveraging advanced bookkeeping tools and software allows organizations to gather and analyze financial data more effectively.

By utilizing robust expense tracking methods, businesses can identify spending patterns and optimize resource allocation. This, combined with accurate budget forecasting, enables informed decision-making, empowering organizations to allocate funds strategically and enhance financial health.

Ultimately, these practices foster greater autonomy and control over financial outcomes.

Conclusion

In summary, effective bookkeeping serves as the backbone of sound financial management, akin to a compass guiding a ship through turbulent waters. By implementing key practices and utilizing appropriate tools, individuals and businesses can uncover valuable insights that inform strategic decisions. This proactive approach not only enhances financial stability but also cultivates a greater sense of control over future outcomes. Ultimately, embracing meticulous bookkeeping fosters resilience and prepares one for the challenges of an ever-evolving financial landscape.