Fundamentals of Bookkeeping for Beginners 4233267442

The fundamentals of bookkeeping for beginners encompass essential practices that facilitate effective financial management. Understanding journal entries and the categorization of transactions into ledger accounts is vital for clarity. Accurate record-keeping not only supports informed decision-making but also enhances operational efficiency. As individuals weigh the merits of manual versus digital methods, they uncover the tools that will empower them. What are the key components that can further enhance their financial control?

Understanding the Basics of Bookkeeping

Although bookkeeping may seem daunting to beginners, understanding its fundamental principles is essential for effective financial management.

Journal entries serve as the initial recording of financial transactions, while ledger accounts categorize these entries for clarity.

Together, they create a structured framework that ensures accuracy and organization, empowering individuals to maintain control over their finances and ultimately achieve greater freedom in their financial decisions.

The Importance of Accurate Record Keeping

Accurate record keeping plays a vital role in the overall success of bookkeeping and financial management. It ensures financial accuracy, allowing businesses to make informed decisions and maintain operational efficiency.

Furthermore, meticulous records facilitate audit preparedness, reducing stress during financial examinations. By prioritizing accurate documentation, individuals and organizations can achieve greater financial freedom and confidence in their financial affairs.

Different Methods of Bookkeeping

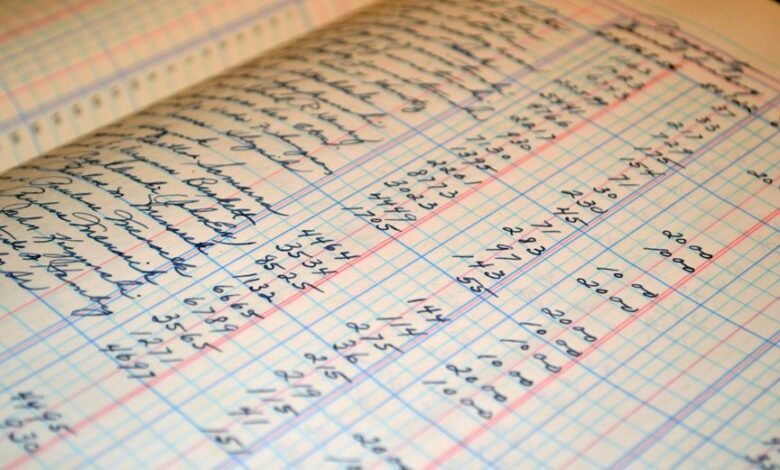

When exploring bookkeeping, it is essential to understand the various methods available for maintaining financial records.

Two primary approaches exist: manual bookkeeping, which involves handwritten ledgers and physical documentation, and digital bookkeeping, utilizing software for streamlined record-keeping and data management.

Each method has its advantages, allowing individuals to choose according to their preferences, resources, and desired level of control over their financial information.

Key Financial Statements and Reports

Key financial statements and reports serve as the foundation for understanding a business’s financial health.

The income statement details revenue and expenses, illustrating profitability over a specific period. In contrast, the balance sheet provides a snapshot of assets, liabilities, and equity at a given moment.

Together, these documents offer valuable insights for informed decision-making and strategic planning, empowering stakeholders to achieve financial independence.

Conclusion

In conclusion, mastering the fundamentals of bookkeeping is essential for anyone seeking financial clarity and control. The theory that effective financial management leads to strategic planning and independence holds true, as accurate record-keeping forms the backbone of informed decision-making. Whether one opts for manual or digital methods, understanding the basics equips individuals to navigate their financial landscape confidently. By embracing these principles, beginners can unlock the potential for growth and ensure their financial endeavors are grounded in solid practices.