Financial Clarity Through Bookkeeping 8447891750

Financial clarity is essential for businesses striving for growth and stability. Professional bookkeeping services play a critical role in achieving this clarity. By ensuring accurate tax preparation and compliance, these services enable businesses to maximize deductions. Furthermore, in-depth financial analysis facilitates informed decision-making. Understanding the full spectrum of support available can illuminate the path to financial freedom. What specific steps can businesses take to enhance their fiscal health through effective bookkeeping?

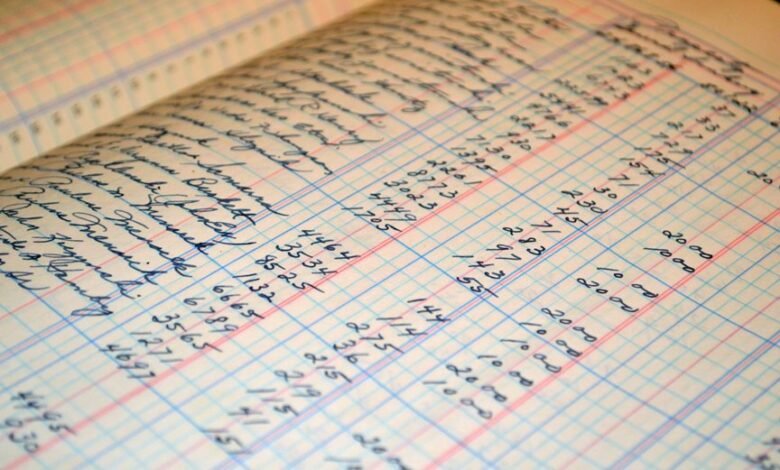

The Importance of Professional Bookkeeping

Professional bookkeeping serves as a cornerstone for effective financial management within any organization.

It ensures the maintenance of accurate records, which are crucial for informed decision-making. Furthermore, professional bookkeeping helps organizations adhere to financial compliance regulations, safeguarding against potential legal issues.

Services Offered by Financial Clarity Through Bookkeeping

Understanding the range of services offered by Financial Clarity Through Bookkeeping reveals how comprehensive support can enhance a business’s financial health.

Their offerings include meticulous tax preparation, ensuring compliance and maximizing deductions, alongside in-depth financial analysis that provides insights into cash flow and profitability.

These services empower business owners to make informed decisions, fostering financial freedom and stability in their operations.

How Bookkeeping Enhances Business Decision-Making

While many business owners may overlook the importance of bookkeeping, a well-organized financial record system plays a pivotal role in enhancing decision-making processes.

Data accuracy ensures that managers rely on reliable information, facilitating effective financial forecasting. By analyzing trends and patterns, businesses can make informed choices, allocate resources wisely, and strategically plan for future growth, ultimately fostering a sense of financial freedom.

Taking the First Step Toward Financial Clarity

Embarking on the journey toward financial clarity requires a systematic approach to bookkeeping.

Establishing budgeting basics is essential for outlining financial goals, while meticulous expense tracking provides insights into spending patterns.

Conclusion

In an ever-evolving financial landscape, the stakes of mismanagement loom large. By entrusting their bookkeeping to professionals like Financial Clarity, businesses not only safeguard their assets but also unlock the potential for informed decision-making. As they weigh the risks of uncertainty against the rewards of meticulous financial oversight, a pivotal choice lies ahead. Will they embrace the clarity that comes from organized records, or remain in the shadows of ambiguity? The path to financial freedom is within reach, yet its pursuit demands decisive action.