The Essentials of Bookkeeping for Small Businesses 4027033006

Bookkeeping serves as the foundation of financial management for small businesses. It involves meticulous record-keeping of financial transactions, which is crucial for insightful decision-making. The right tools can enhance clarity, while common mistakes can undermine a business’s financial health. Understanding these essentials not only aids in tracking cash flow but also positions entrepreneurs for sustainable growth. However, the nuances of effective bookkeeping require careful consideration and strategy. What specific tools and practices can ensure accuracy and efficiency?

Understanding the Basics of Bookkeeping

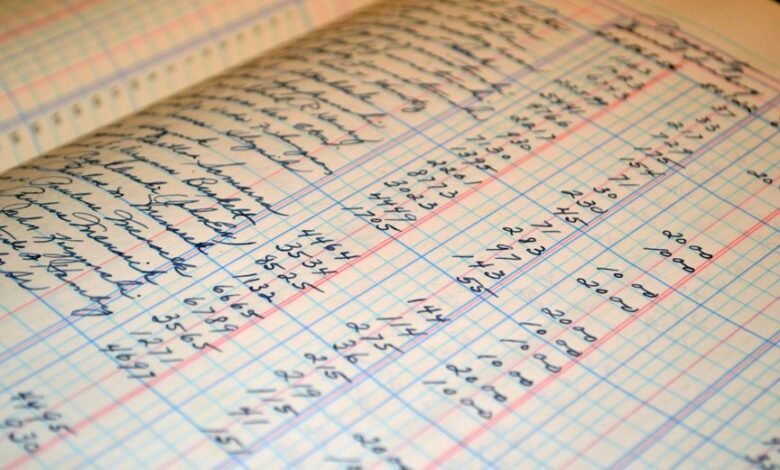

Bookkeeping serves as the foundational framework for small businesses, encompassing the systematic recording, categorization, and analysis of financial transactions.

Understanding basic bookkeeping principles is crucial, as it enables entrepreneurs to maintain accurate records and prepare for financial statement analysis.

This process fosters informed decision-making, ensuring that business owners can navigate their financial landscapes effectively while maintaining the freedom to grow and innovate.

Essential Bookkeeping Tools for Small Businesses

Effective financial management relies heavily on the right tools to ensure accuracy and efficiency.

Small businesses benefit significantly from cloud software, which facilitates real-time access to financial data and simplifies collaboration.

Additionally, robust expense tracking systems allow for meticulous monitoring of expenditures, empowering business owners to make informed decisions.

These essential tools foster financial clarity and support sustainable growth in a competitive landscape.

Common Bookkeeping Mistakes to Avoid

Utilizing the right tools can significantly enhance bookkeeping practices, yet even with these resources, small businesses often fall prey to common mistakes that can jeopardize their financial health.

Frequent errors include inaccurate data entry, leading to flawed financial reports, and poor expense tracking, which can obscure genuine cash flow.

Acknowledging these pitfalls is essential for maintaining a robust financial foundation and ensuring long-term success.

Tips for Maintaining Accurate Financial Records

Although maintaining accurate financial records can be a challenging task for small businesses, implementing systematic practices can greatly enhance reliability and transparency in financial reporting.

Prioritizing financial organization through regular updates and categorization of transactions is crucial.

Additionally, establishing a robust record retention policy ensures that important documents are preserved for compliance and reference, ultimately fostering a culture of accountability and informed decision-making.

Conclusion

In the grand scheme of business, one might think that bookkeeping is merely a mundane chore, a task to be relegated to the back burner. Ironically, it is this very diligence in financial record-keeping that distinguishes the thriving entrepreneur from the struggling one. By embracing the essentials of bookkeeping, small business owners can transform what seems like a tedious obligation into a powerful tool for strategic insight and growth, ultimately revealing that the mundane holds the keys to success.