Crafting a Financial Strategy With Bookkeeping 4324980251

Effective financial strategy hinges on robust bookkeeping practices. Accurate record-keeping not only ensures compliance but also provides key insights for forecasting and decision-making. This analytical approach allows organizations to identify trends and optimize resource allocation. Yet, many overlook the transformative potential of technology in simplifying these processes. Understanding the intersection of bookkeeping and strategic financial management reveals critical pathways to sustainable growth and operational efficiency. What are the key elements that will shape this evolving landscape?

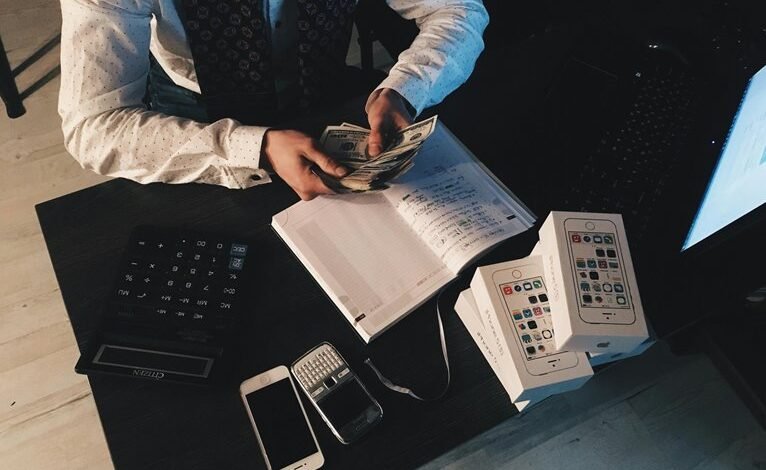

The Importance of Bookkeeping in Financial Strategy

While many businesses focus on strategic planning and revenue generation, the role of bookkeeping in financial strategy is often underestimated.

Accurate bookkeeping ensures tax compliance and provides essential data for financial forecasting. By maintaining organized financial records, businesses can make informed decisions, identify trends, and allocate resources effectively.

Ultimately, this fosters a foundation for sustainable growth and operational freedom in an evolving market.

Key Components of Effective Bookkeeping

Effective bookkeeping serves as the backbone of any financial strategy, encompassing several key components that ensure accuracy and reliability in financial reporting.

Essential elements include meticulous record retention to safeguard financial documentation and thorough expense tracking to monitor spending patterns.

These components facilitate informed decision-making and promote financial transparency, ultimately empowering individuals and businesses to maintain control over their financial futures.

Leveraging Technology for Streamlined Bookkeeping

As businesses increasingly seek efficiency in their financial processes, leveraging technology for streamlined bookkeeping has become essential.

Cloud software enables real-time data access and collaboration, while automation tools reduce manual entry errors and save time.

Making Informed Decisions With Accurate Financial Data

Accurate financial data serves as the foundation for informed decision-making within organizations.

Data accuracy enhances the reliability of financial forecasting, enabling businesses to anticipate future trends and allocate resources effectively.

Informed decisions, grounded in precise data, empower organizations to adapt to market changes, optimize investments, and ultimately achieve financial independence.

This strategic approach fosters a culture of accountability and promotes long-term sustainability.

Conclusion

In the intricate tapestry of financial strategy, bookkeeping serves as the sturdy thread that weaves together compliance, insight, and foresight. By embracing meticulous record-keeping and technological advancements, organizations transform raw data into a compass guiding them through the complexities of fiscal landscapes. This proactive approach not only cultivates stability but also empowers decision-makers to navigate with confidence, ensuring long-term goals are not just envisioned but realized. Ultimately, effective bookkeeping is the foundation upon which sustainable growth is built.