Building Financial Stability With Bookkeeping 3145648000

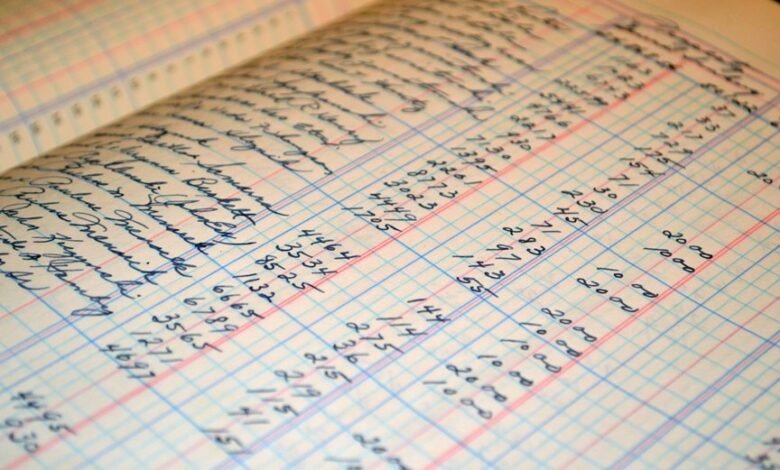

Building financial stability is a crucial objective for businesses, and bookkeeping plays a pivotal role in achieving this goal. Bookkeeping 3145648000 provides expert services that meticulously track income and expenses, fostering informed decision-making. By offering tailored financial reporting and tax preparation, this service enhances transparency and compliance. However, understanding the specific benefits and steps to engage with such a service is essential for maximizing its potential impact on long-term financial success.

Understanding the Role of Bookkeeping in Financial Health

Bookkeeping plays a pivotal role in establishing and maintaining financial health for businesses of all sizes.

Through meticulous financial tracking and effective expense management, it empowers organizations to make informed decisions, identify cost-saving opportunities, and optimize resource allocation.

Key Services Offered by Bookkeeping 3145648000

Effective bookkeeping services can significantly enhance a business’s financial stability by providing a comprehensive suite of offerings tailored to meet diverse organizational needs.

Bookkeeping 3145648000 specializes in essential services such as tax preparation and financial reporting, ensuring compliance and accuracy.

Benefits of Professional Bookkeeping for Individuals and Businesses

While many individuals and businesses may underestimate the importance of professional bookkeeping, its advantages are substantial and multifaceted.

Effective bookkeeping fosters financial clarity, enabling informed decision-making and strategic planning. Additionally, it often results in significant cost savings by identifying inefficiencies and optimizing expenditures.

Ultimately, professional bookkeeping empowers individuals and businesses to achieve greater financial stability and pursue their aspirations with confidence.

Steps to Get Started With Bookkeeping 3145648000

Achieving financial stability through professional bookkeeping involves a systematic approach to establishing and maintaining financial records.

To get started, individuals should focus on basic bookkeeping principles, such as tracking income and expenses, categorizing transactions, and utilizing accounting software for financial organization.

Regularly reviewing financial statements will enhance clarity, enabling informed decisions that promote long-term financial freedom and stability.

Conclusion

In conclusion, leveraging the services of Bookkeeping 3145648000 represents a crucial step toward achieving financial stability. By ensuring meticulous tracking of income and expenses, businesses can navigate the financial landscape with confidence. With tailored reporting and expert guidance, companies are well-equipped to avoid pitfalls and seize opportunities. As the saying goes, “A stitch in time saves nine,” making proactive bookkeeping not just a service but an essential investment in long-term success and stability.