Bookkeeping for Enhanced Financial Outcomes 7028293323

Effective bookkeeping serves as the backbone of financial stability for businesses. Accurate transaction recording ensures data integrity and informs strategic decision-making. By leveraging professional bookkeeping services and digital tools, organizations can enhance compliance and reduce financial risks. However, many still overlook the critical aspects that can elevate their bookkeeping practices. Understanding these nuances may lead to improved financial outcomes and sustainable growth, prompting a closer examination of best practices in this essential area.

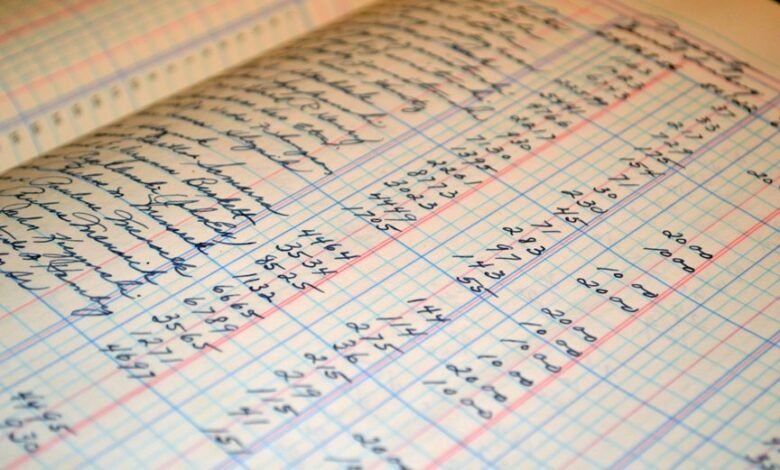

The Importance of Accurate Bookkeeping

Accurate bookkeeping serves as the backbone of effective financial management for businesses of all sizes.

It ensures financial accuracy by meticulously recording transactions, which in turn upholds data integrity. This foundational practice not only aids in compliance with regulations but also provides a clear financial picture, empowering businesses to make informed decisions.

Ultimately, accurate bookkeeping fosters autonomy, promoting sustainable growth and resource allocation.

Key Benefits of Effective Financial Record-Keeping

Effective financial record-keeping offers numerous advantages that can significantly enhance a business’s operational efficiency and strategic planning.

By ensuring financial clarity, businesses can make informed decisions, identify trends, and optimize resource allocation.

Moreover, meticulous records support tax compliance, minimizing the risk of audits and penalties.

Ultimately, effective record-keeping empowers businesses to maintain financial health and pursue growth opportunities with confidence.

Tips for Improving Your Bookkeeping Practices

Building on the advantages of effective financial record-keeping, businesses can further enhance their bookkeeping practices through specific strategies.

Utilizing digital tools streamlines data entry and reporting, increasing accuracy and efficiency.

Additionally, conducting regular audits ensures compliance and identifies discrepancies early, fostering a proactive approach to financial management.

These practices empower businesses to maintain clarity and control over their financial outcomes.

The Role of Professional Bookkeeping Services

While many businesses attempt to manage their bookkeeping internally, the expertise offered by professional bookkeeping services can significantly enhance financial accuracy and strategic decision-making.

Outsourcing bookkeeping allows organizations to focus on core activities while benefiting from thorough financial analysis. This collaboration not only ensures compliance with regulations but also provides insights that drive informed choices, ultimately fostering financial freedom and growth.

Conclusion

In the realm of financial management, accurate bookkeeping stands as a sturdy bridge connecting raw data to strategic decision-making, while chaos lies in the shadows of disorganized records. Effective financial record-keeping transforms potential pitfalls into pathways for growth, contrasting the uncertainty of mismanagement with the clarity of informed choices. By integrating professional bookkeeping services, organizations can navigate the complexities of compliance and risk, ensuring that their financial health flourishes amidst the dynamic landscape of business opportunity.