Achieving Financial Clarity With Bookkeeping 4844522185

Achieving financial clarity through effective bookkeeping is crucial for organizations aiming for sustainable growth. Accurate record-keeping and timely reconciliations enable businesses to monitor expenses and discern spending patterns. This financial transparency not only reassures stakeholders but also informs strategic decision-making. However, without the right techniques and tools, many organizations struggle to maintain this clarity. Understanding the key aspects of bookkeeping could reveal pathways to improved financial health and stability.

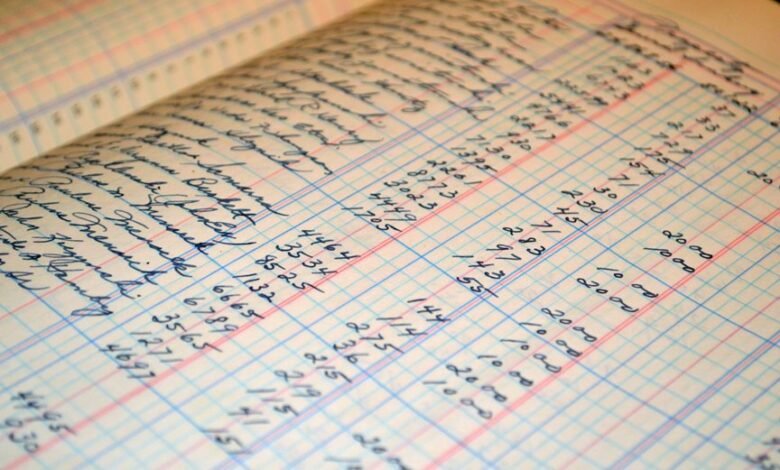

The Importance of Bookkeeping for Financial Clarity

How can effective bookkeeping enhance financial clarity?

By establishing robust financial organization, bookkeeping allows individuals and businesses to maintain accurate records. This practice facilitates precise expense tracking, enabling stakeholders to identify patterns and make informed decisions.

Consequently, enhanced financial clarity not only promotes better budgeting but also empowers individuals to exercise greater control over their financial futures, fostering a sense of freedom and security.

Key Features of Bookkeeping 4844522185

Effective bookkeeping encompasses several key features that collectively enhance financial management.

These include accurate record-keeping, timely reconciliations, and detailed financial reporting. Each key feature contributes to significant bookkeeping benefits, such as improved cash flow monitoring and informed decision-making.

Techniques to Streamline Your Bookkeeping Process

Streamlining the bookkeeping process is essential for businesses seeking to enhance efficiency and accuracy in financial management.

Implementing automated tools can significantly reduce manual entry errors and save time.

Additionally, effective expense tracking through software solutions allows for real-time oversight of expenditures.

How Bookkeeping Can Help You Make Informed Financial Decisions

Accurate bookkeeping serves as a foundation for informed financial decision-making within any organization.

By facilitating comprehensive financial analysis, it allows leaders to assess performance, identify trends, and allocate resources effectively.

This clarity enables strategic decision-making, empowering organizations to seize opportunities and mitigate risks.

Ultimately, robust bookkeeping practices foster financial independence, equipping stakeholders with the insights necessary for sustainable growth and autonomy.

Conclusion

In summary, effective bookkeeping is indispensable for achieving financial clarity, as it equips organizations with the insights needed for sound decision-making. By embracing automated tools and streamlined processes, businesses can enhance their financial oversight, ultimately fostering a culture of transparency and trust among stakeholders. As the adage goes, “A penny saved is a penny earned,” illustrating that meticulous tracking of expenses not only conserves resources but also empowers organizations to thrive in a competitive landscape.